To accumulate Bitcoin, we are familiar with institutions like MicroStrategy and Bitcoin iShares. Similarly, DeFi Development Corp is now becoming the first public company to adopt a Solana-based treasury strategy. Moreover, they announced that they currently hold 999,999 SOL and SOL equivalents on their balance sheet.

Between July 14 and July 20, they purchased 141,383 SOL at an average price of $133.89, adding around $19 million in new holdings. Only one SOL remains to complete 1 million. The company stated this as a symbolic goal of reaching 1 million SOL.

DeFi Development’s $181 Million Solana Holdings

Since April, DeFi Development has been heavily accumulating SOL. The company is based in Florida. Surprisingly, they now hold around $181 million worth of SOL, which includes both spot purchases and discounted locked tokens. Their latest purchase includes 867 SOL.

As of July 18, the company had 19,445,837 shares, making the SOL per share (SPS) 0.0514 a 13% increase compared to the previous week. Their goal is to reach 1 SPS by December 2028 and 0.1650 SPS by June 2026.

To support this accumulation strategy, DeFi Development has used a $5 billion equity line of credit, of which only 0.4% has been utilized so far. Around $19.2 million has been drawn, with $5 million allocated for future purchases.

Interestingly, beyond accumulating tokens, DeFi Development recently launched the DFDV Treasury Accelerator. This is an international expansion program built on a franchise model. According to our research, this initiative will help global partners build their own Solana treasuries. As a result, DeFi Development is expected to retain equity shares in regional operations.

DeFi Development has a long-term strategy to protect and grow its SOL position through staking rewards and validator income. Currently, almost all of their unlocked SOL is staked. They are also earning additional revenue from third-party delegators who use their validator.

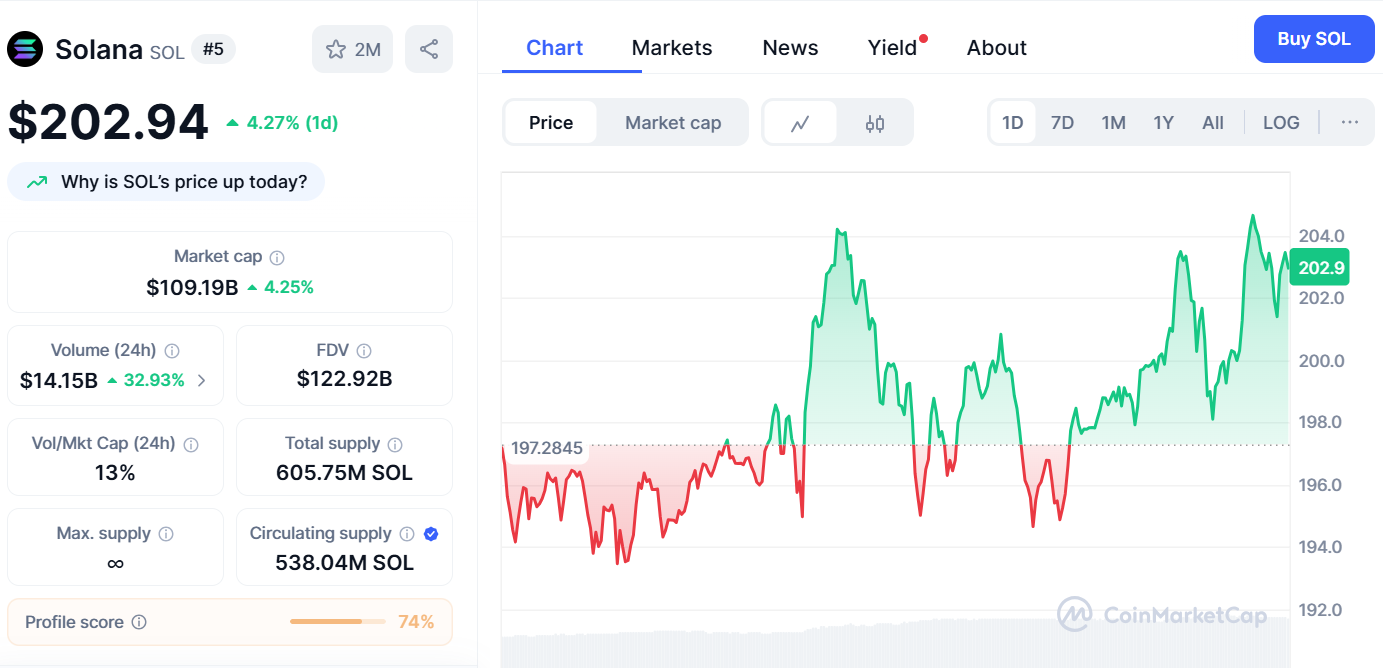

Solana Reclaims $100 Billion Market Cap

In January 2025, Solana’s market cap was $100 billion. After a market downturn, it fell below that level. Recently, with DFDV’s treasury growing rapidly, Solana’s market cap has again crossed the $100 billion mark.

At the time of writing this article, Solana’s total market cap is $109.19 billion. With a 4.25% price increase in the past 24 hours, the current price per token has reached around $202.94.

This rise has made Solana the 5th largest crypto asset, now ahead of Binance Coin (BNB) by $2.08 billion.

Several recent developments have also contributed to Solana’s growth. The launch of the REX-Osprey SOL + Staking ETF has increased investor interest. Additionally, various institutions are showing more interest. The rising DEX trading volume on Solana has created a positive market sentiment.

According to Syndica data, in the first half of 2025, Solana DEXs processed over $1 trillion in transactions more than the previous two six-month periods combined. Public companies now collectively hold about 1.85 million SOL, which is around 0.35% of the total supply.

BIT Mining also recently announced plans to raise up to $300 million for creating a SOL treasury. Meanwhile, SOL Strategies already listed on the Canadian Securities Exchange is holding over 420,000 SOL.

Conclusion

Due to Solana’s price movements, analysts are now more interested in SOL as it has broken the key resistance level of $190. According to on-chain data from Glassnode, over 8 million SOL has been bought at this level, suggesting the next possible target could be around $230.